Introduction

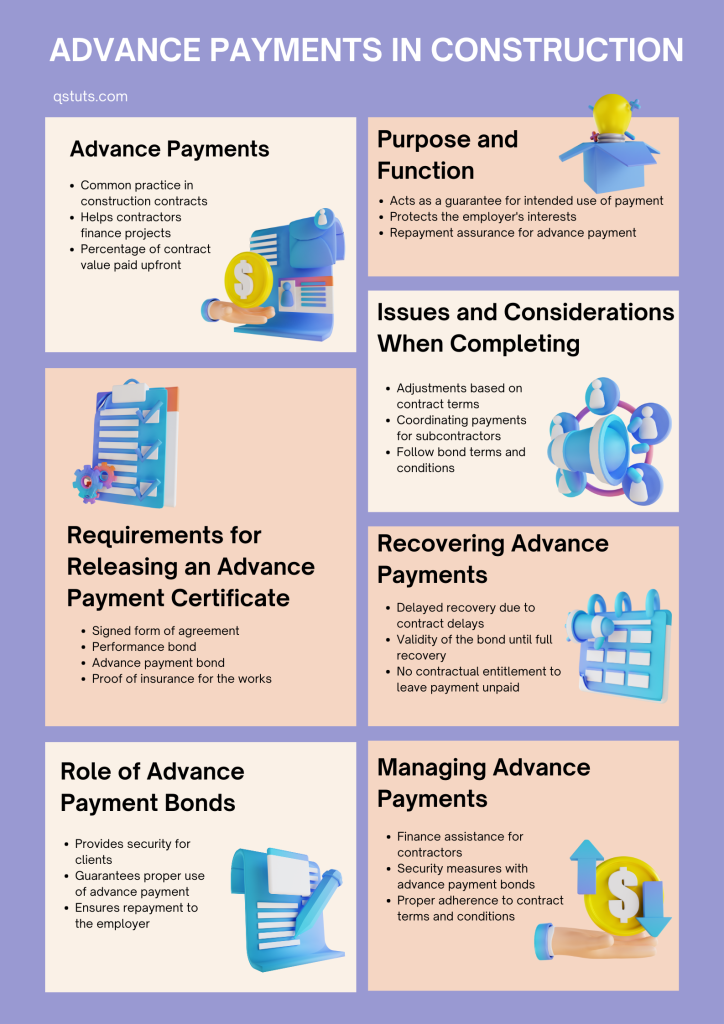

Advance payments are a common practice in construction contracts, where the contractor is paid a percentage of the contract value before any work is done. This can be an effective way to help contractors finance their projects and get started with the work. However, advance payments also come with specific requirements and considerations that must be taken into account. In this article, we will explore the role of advance payment bonds and the requirements for completing the advanced payment certificate, as well as some of the issues and considerations that arise when it comes to recovering advance payments. Whether you are a contractor, client, or quantity surveyor, understanding the nuances of advance payments can help ensure a successful project outcome.

Understanding Advance Payment in Construction Contracts

When it comes to post-contract cost consultancy services, payments are a crucial aspect that falls under the responsibility of the cost consultant or quantity surveyor. In particular, advance payments can help contractors get started on their work before they receive progress payments. However, clients cannot simply give payments to contractors without some form of security, which is why advance payment bonds are necessary.

The FIDIC Standard Conditions of Contract for Construction (1999 Red Book) specify the requirements for advance payments. It says that the Employer shall make an interest-free loan to the Contractor for mobilization when the Contractor submits a guarantee in accordance with this clause. The amount and timing of the advance payment will be as stated in the Appendix to Tender.

According to these conditions, contractors can receive an advance payment certificate equal to 10% of the contract value upon signing the form of agreement and providing a performance bond and separate guarantee for the advance payment. It’s important to note that the contract value is agreed upon in the letter of acceptance and remains unchanged until the completion of the contract.

To release an advance payment certificate, contractors must have;

- A signed form of agreement,

- A performance bond (usually 5% of the contract value),

- An advance payment bond (usually 10% of the contract value excluding contingencies and provisional sums), and

- Proof of insurance for the execution of the works.

Once all of these requirements are met, the contractor can proceed with the advanced payment certification.

The Role of Advance Payment Bond

In any construction project, there are certain payments that need to be made in advance to ensure the timely execution of the project. However, such payments can also pose a risk to the employer if the contractor fails to fulfill their contractual obligations. This is where an advanced payment bond comes into play.

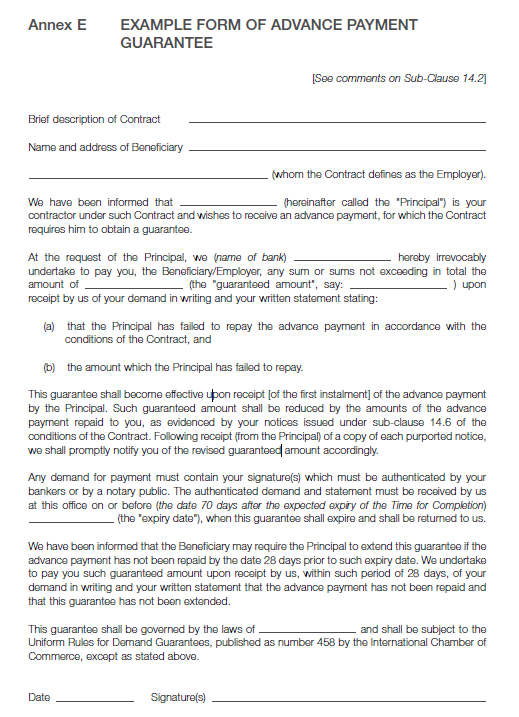

An advanced payment bond is a type of surety bond that acts as a guarantee to the employer that the contractor will use the advanced payment for the purpose stated in the contract. Therefore, this bond guarantees the repayment of an advanced payment made by an employer.

It is important to adhere strictly to the requirements outlined in the bond template, and any deviations must be corrected by the contractor before the bond can be accepted. As a quantity surveyor, it is crucial to ensure that the names of the parties, the title of the project, the project duration, and the Contract value are correctly stated in the Advanced Payment Certificate. This certificate establishes the requirements for all future payment certifications til final accounts and must be precise.

When completing the Advanced Payment Certificate, it is important to note that no deductions should be made from the advanced payment amount. This payment is made prior to any work being done, and the full amount should be released to the contractor, with all guarantees secured to the employer.

It is also important to be aware of the bond’s specific terms and conditions, including the effective date and expiration date. Any deviations from the bond’s terms and conditions must be reviewed and approved by the employer.

Issues When Completing the Advanced Payment Certificate

When it comes to contracts and payments, it’s important to stick to the terms agreed upon in the contract. For example, if an advance payment has been made as per the contract terms, and the client later decides to make an omission from the scope of work, it is important to consult the contract to determine whether any adjustments can be made to the advance payment.

If the contract states that the advance payment should be a certain percentage of the contract value, without any provision for contingencies or provisional sums, then the contractor has no authority to make any adjustments to the payment. However, if the contract specifies that the advance payment should be reduced to reflect changes in the contract value, then the contractor should follow those terms.

It’s also important to understand the different types of work that are defined and undefined in a contract. For example, prime cost sums are a defined type of work that will be carried out by nominated subcontractors, while provisional sums are undefined and may or may not be necessary. The contractor is responsible for planning all the work, including provisional sums, in their program and must coordinate with subcontractors to ensure that the work is completed on time and to the required standard.

There are primarily two categories of subcontractors, namely domestic subcontractors and nominated subcontractors. A domestic subcontractor is employed by the main contractor and operates under a private agreement between the two parties. Nominated subcontractors are appointed by the Client.

When it comes to subcontracting work, the domestic subcontractor’s advance payment is usually made by the main contractor, not the client. On the other hand, The client may need to release separate advance payments for nominated subcontractors, but this can be a complex process that requires careful coordination.

Ultimately, contractors need to be aware of their cash flow and plan accordingly. If the contract specifies that the advance payment excludes provisional sums, for example, then the contractor should not expect to receive any additional payments for that work. However, when the provisional sum was awarded later on, the client paid an advanced payment separately for the awarded package.

How to Recover the Advance Payments: Issues and Considerations

In the world of contracts, advance payment is a common practice where the contractor is paid a percentage of the contract value before any work is done. This is usually done to help the contractor finance the project and get started with the work. However, advance payment can sometimes be confusing and lead to issues during the contract period.

One such issue is the recovery of advance payments. When the contract is delayed, the recovery of advance payments also gets delayed. In such a scenario, if the contractor has taken an advanced payment bond for one year, and it is delayed, the situation can become complicated.

If the bond is not fully recovered by the completion date of the contract, Does this mean the contractor will have to find a way to renew the bond, just like other types of bonds?

It is not required. Because, in standard conditions, the bond is valid until the completion date of the contract or until the full amount of the advance payment is recovered, whichever is later. “whichever is later” means advance payment is fully valid until full Advance payment is recovered. It is important not to alter this term because if the advanced payment is not fully recovered even after the completion date, the bond is still valid. Therefore, there is no need to get an extension to the bond.

However, in some cases, the banks may change the term from whichever is later to whichever is earlier. This means that if the advance payment is not fully recovered even after the completion date, the bond will become invalid. In such a scenario, an extension of the bond will be required, which should not be entertained.

When it comes to the recovery of advance payments, it is essential to note that there is no contractual entitlement to leave it after the completion certificate. The contract states that the recovery of advance payments should be fully recovered at the time of completion. Therefore, it is crucial to recover any outstanding amount at the time of releasing the first moiety (retention).

Sometimes, the contract includes an advance payment provision, but the contractor is not taking advance payment. After a few months, the contractor requests advance payment. In such a situation, the contractor is entitled to take advance payment according to the terms stipulated in the contract. The contractor must give the advance payment bond as per the terms stipulated in the contract.

It is important to release the advance payment as a single certificate and not mix it with any value of work done. This is because advance payment is a different payment method, and releasing it separately helps to avoid confusion. Once the advance payment is made, the recovery process must begin immediately, and 10% of the contract value should be deducted from future interim payments until fully recovered.

If the advance payment has not been repaid prior to the issue of the completion certificate / Taking-Over Certificate for the Works or prior to termination or any force major case, the whole of the balance outstanding amount shall immediately become due and payable by the Contractor to the Employer.

Conclusion

Overall, advance payments can be a useful tool for facilitating cash flow and getting contractors started on their work. However, it’s important to follow the stipulations outlined in the contract and ensure that all necessary documentation is in order before releasing an advance payment certificate.

The Advanced Payment Bond is a crucial component of any construction project, and adherence to its terms and conditions is essential to ensure a successful project outcome. As a contractor, it is important to follow the terms stipulated in the contract and ensure that advance payments are recovered fully and in a timely manner.

1 thought on “Advance Payment Bond & Certification : Ultimate Guide”