What is Life Cycle costing in Construction?

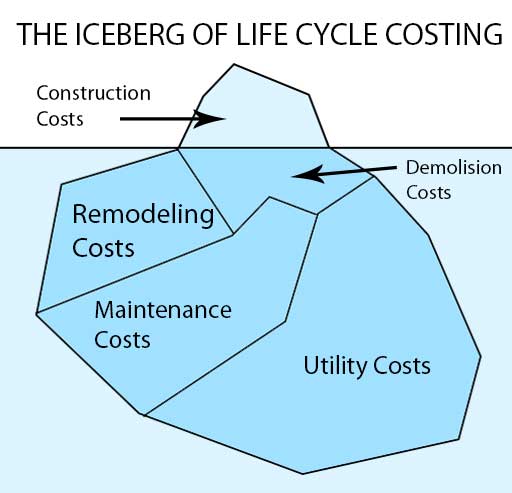

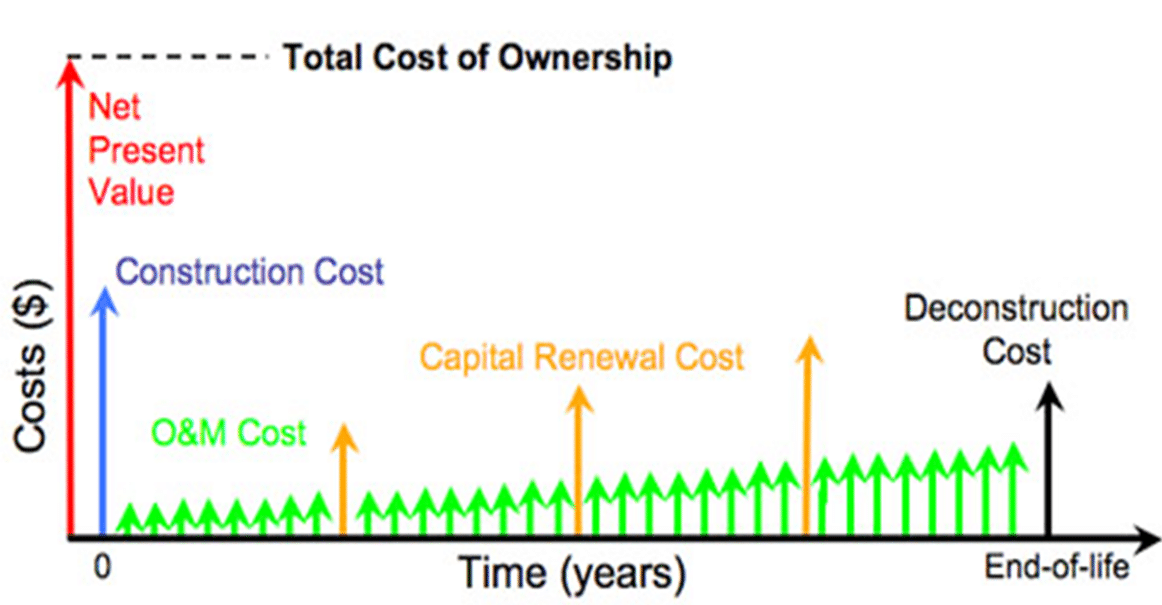

Life cycle cost (LCC) is a system used to calculate the total cost of an asset throughout its lifetime. This cost is calculated in present value and takes into account the initial capital cost, job-related fees, operational costs, and maintenance costs. It also accounts for the eventual disposal costs at the end of the asset’s lifetime.

Life cycle cost is the overall expense that a project will incur over its entire life. To calculate it, we must take into account all future costs, which can be done by discounting techniques. This allows us to get a better understanding of the economic value of the project.

There are a few different terms that mean the same as Life Cycle Costing, such as Total Cost, The Total Cost of Ownership, Ultimate Life Cost, Through Life Cost, Cost in Use, and Total Life Cost.

Doing things the right way from the start can save you time and money in the long run. LCC usually asks answers for to the following questions;

- what do I need to do now and what will it cost me?

- What will I need to do in the future because of how I did it at the beginning and how much will that cost?

- How long will the analysis take?

- And how can I compare future costs to current costs?

Answering these questions can help you make informed decisions and plan for the future.

Standards and Guidelines

There are few standards and guidebooks for the evaluation of the life cycle cost. Estimating and budgeting for building maintenance can be made easier with the help of standards and guidebooks.

- RICS NRM 3 – October 2021: Order of cost estimating and cost planning for building maintenance works (2021)

- BS 8544 : Guide for life cycle costing of maintenance during the in-use phases of buildings (2013)

- ISO 15686-5:2017: Buildings and constructed assets — Service life planning — Part 5: Life-cycle costing (2017)

Current Practice of LCC in the UK

- A tool to provide early cost guidance (focusing on the best value rather than the cheapest cost) can be beneficial.

- Project evaluation and design appraisals can be improved through sustainable decision-making, taking into account energy use and the cost of maintenance for different design options.

- When budgeting, life-cycle cost (LCC) analysis can be used to predict the future cash flow of an asset and is especially useful when cost planning and tendering.

- Lastly, cost reconciliation can benefit greatly from LCC analysis.

What is Whole Life Cycle Costing (WLC?)

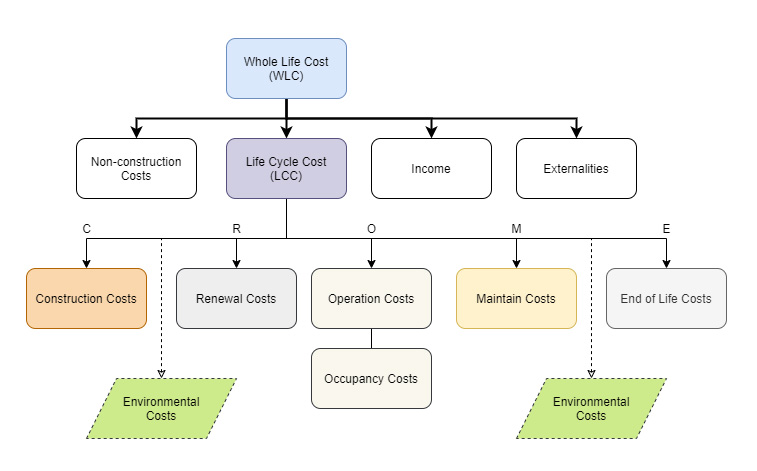

The whole life cycle costing method has vast scope than life cycle costing. It includes none construction costs, incomes, and externalities as well as life cycle costs. Therefore we require non-construction professionals such as; accountants, valuers, etc. to evaluate the whole life cycle cost.

What is the difference between whole life costing and life cycle costing?

The following diagram shows the difference between WLC and LCC.

As mentioned in the above chart, We must take into account a variety of expenses that aren’t related to construction, such as the purchasing of land, fees, and rent, as well as any applicable taxes. All of these costs must be taken into consideration.

Objectives of Life Cycle Costing

- Proper evaluation of investment opportunities and options: Also, LCC analyses, the best solution among alternative proposals. Therefore option appraisal will be done more effectively.

- Proper evaluation of the whole project in terms of lifecycle cost, instead of the total initial cost: LCC determines the total cost commitment for the project at the very initial stage. Because of that, cash flow prediction will be easy and more accurate.

- Proper management of the asset throughout its whole life: Furthermore, LCC acts as a management or planning tool.

Why is LCC important?

Now we are going to discuss What are the benefits of life cycle costing?

- Early assessment of risk and early preparation for future uncertainties.

- Optimizes the total cost of ownership.

- Enables to promote realistic budgeting for future costs such as operating costs, maintenance costs, and repair costs.

- Act as a decision-supporting or decision-making tool.

- Proper evaluation of business needs and identification of investment options and opportunities.

- Provide actual figures for future milestones.

- At the beginning of the project, it allows for early discussions regarding the material quality, durability, and specifications.

- It allows for obtaining the greatest value for the money spent.

- Proper planning and monitoring of the project throughout its life.

- Global warming.

Limitations

- Most of the time, ignorance by the client

- Lack of awareness of the importance of life cycle costing

- Complex calculations

- Lack of tangible evidence

- Lack of reliable evidence

- Poor framework for collecting data

- The necessity of the experts for the life cycle costing process

Process of Life Cycle Cost Analysis

- Establish the purpose

- This is the very first and most important step of life cycle costing. This step defines the aims and objectives of the project. These aims and objectives should be very clear and unbiased.

- Determine the choices of alternatives

- This step is to identify the possible alternatives to achieve the project’s aims and objectives.

- Formulate assumptions

- The third step is to formulate reasonable assumptions. Since LCC is based on future costs and expenditures, their lots of uncertainties, and because of that, the assumptions should be stated very clearly and explicitly. LCC makes assumptions for price escalation in materials, plants, and labor rates.

- Establish a period of analysis

- Here, the economic or physical lifespan of the project will be identified.

- Estimate total costs over the life span of the project in present value.

- The estimate of the total cost of the building over its life span will calculate by using present value calculation. This step is also very important in the life cycle costing procedure. This calculation needs to be done very accurately.

- Compare costs and rank the alternatives.

- After the calculation of the total costs of all alternatives, comparing and ranking will be done. There are a few techniques that we can use to rank the alternatives in LCC. Such as,

- Net present value

- Savings – investment rations

- Internal rate of return

- Annual equivalent rate

- After the calculation of the total costs of all alternatives, comparing and ranking will be done. There are a few techniques that we can use to rank the alternatives in LCC. Such as,

- Undertake sensitivity analysis.

- After identifying the most suitable alternative in step 6, we shall do a sensitivity analysis. It helps to check whether the selected proposal is correct or not. This analysis provides a clear picture of the project to the decision-maker.

What are the data required for the LCC?

There are four main data required for the process of life cycle costing. They are;

- Cost data

- Timing of them

- The present value of them

- Sensitivity analysis

1. Cost Data

The following cost data are required for the process of life cycle costing.

- Construction costs (When year zero costs)

- Site costs, Construction, and infrastructure costs, finance charges, professional fees, statutory charges, development grants, etc.

- Renewal costs

- Decorations, services, fabrics, etc.

- Maintenance costs

- Utility, cleaning costs, etc.

- Operation and occupancy costs

- Non-construction costs such as Staff salaries, reception, security, cleaning, catering, rent, insurance, heating, lighting, AC, IT services, etc.

- End-of-life span costs

- Disposal, reinstatement, or demolish costs

- Environment costs

- Embodied and operational energy, carbon, etc.

2. Time of occurrence

The client is the person who decides the period of analysis in LCC. The time of occurrence of the above-discussed costs data needs to be known.

3. Present value consideration

Time value of money

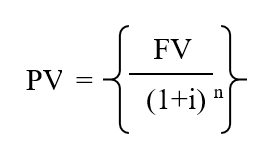

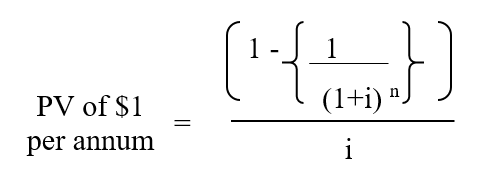

Throughout the project’s lifespan, the costs will arise at different amounts at different times. For the life cycle costing process, costs need to express commonly. So the discounting method is identified to convert future values into its current equivalent. The time value of money means the rate at which the future money is discounted. Different discount rates are effective in the present value calculation. When the interest rate is high, the present value of the future cost is low.

We use the following equation to calculate the present net value of future costs.

- The present value of a lump sum paid to be in the future

PV= Present Value

FV = Future Value

i = Discount rate (borrowing rate)

n = number of years

- Year’s Purchase ( Present value of irregular annual payment for the number of years)

4. Sensitivity Analysis

Sensitivity analysis helps to manage the risks of the project. And also, this analysis helps to identify the most reasonable project proposal by changing variables such as the life span of the building, lifespan of the component, discount rate, and estimated initial cost. For example, take different discount rates and analyze the effects on the total lifecycle cost of the building. After changing different variables and looking at the results, it can easily identify the ideal project proposal for the client.

Example of Life Cycle Costing

This Example is based on life cycle costing for alternative design proposals.

A Client a factory to be erected comprising of 2500m2 production area and 350m2 of Office area. The designer has put forward two design proposals and Quantity Surveyor is to undertake a Life cycle costing based on the two designs and advice on which is the most economical design based on value for money over the project life cycle.

Cost data:

- The economic life of the building – 35 Years

- Agreed discount rate – 6%

Assume no replacement or maintenance in the final year

Here’s the corrected and formatted table for better readability:

| Details | Design A | Design B |

|---|---|---|

| Production Area | ||

| GIFA | 2500m² | 2500m² |

| Capital | $75/m² | $98/m² |

| Annual Maintenance | $38,000 | $32,000 |

| Office Area | ||

| GIFA | 350m² | 350m² |

| Capital | $83/m² | $85/m² |

| Annual Maintenance | $8,500 | $9,750 |

| Cyclical Maintenance | ||

| External Painting | $35,000 (7 Years Period) | $30,000 (9 Years Period) |

| Internal Painting | $19,000 (5 Years Period) | $15,000 (5 Years Period) |

| Flat Roof | $35,000 (10 Years Period) | $40,000 (20 Years Period) |

| Replace Window | $70,000 (15 Years Period) | None |

How to Calculate Life Cycle Cost?

Here, we are going to use formula (b) for the Annual Maintenance calculations and formula (a) for the Cyclical Maintenance calculations.

Calculation of Capital Cost

| Design A | Design B |

|---|---|

| Capital Cost = (2500 x 75) + (350 x 83) | Capital Cost = (2500 x 98) + (350 x 85) |

| = 187,500 + 29,050 | = 245,000 + 29,750 |

| = 216,550 | = 264,750 |

Calculation of Annual Maintenance Cost

- Apply formula (b) to find the Discount factor.

| Design A | Design B |

|---|---|

| Year Number = 35 | Year Number = 35 |

| Discount Rate = 6% | Discount Rate = 6% |

| Discount Factor = 14.498 | Discount Factor = 14.498 |

| Annual Maintenance Cost = Cost x DF | Annual Maintenance Cost = Cost x DF |

| = (38,000 x14.498) + (8,500 x14.498) | = (32,000 x14.498) + (9,750 x14.498) |

| = 569,924 + 123,233 | = 463,936+ 141,355.50 |

| = 693,157 | = 605,292 |

Calculation of Cyclical Maintenance Cost For External Painting

- Apply formula (a) to find Discount Factors (DF) below

| Design A | Design B |

|---|---|

| Future Value = 1$ | Future Value = 1$ |

| Discount Rate = 6% | Discount Rate = 6% |

| External Painting -$35,000 (7 Years Period) | External Painting -$30,000 (9 Years Period) |

| 7th Year = 0.665 | 8th Year = 0.592 |

| 14th Year = 0.442 | 18th Year = 0.350 |

| 21st Year = 0.294 | 27st Year = 0.207 |

| 28th Year = 0.196 | |

| 35th Year = Nill | |

| Total DF = 1.597 | Total DF = 1.149 |

| External Painting Cost = Cost x DF | External Painting Cost = Cost x DF |

| = 35,000 x 1.597 | = 30,000 x 1.149 |

| = 55,895 | = 34,470 |

Calculation of Cyclical Maintenance Cost For Internal Painting

| Design A | Design B |

|---|---|

| Future Value = 1$ | Future Value = 1$ |

| Discount Rate = 6% | Discount Rate = 6% |

| Internal Painting – $19,000 (5 Years Period) | Internal Painting – $15,000 (5 Years Period) |

| 5th Year = 0.747 | 5th Year = 0.747 |

| 10th Year = 0.558 | 10th Year = 0.558 |

| 15th Year = 0.417 | 15th Year = 0.417 |

| 20th Year = 0.312 | 20th Year = 0.312 |

| 25th Year = 0.233 | 25th Year = 0.233 |

| 30th Year = 0.174 | 30th Year = 0.174 |

| 35th Year = Nill | 35th Year = Nill |

| Total DF = 2.441 | Total DF = 2.441 |

| External Painting Cost = Cost x DF | External Painting Cost = Cost x DF |

| = 19,000 x 2.441 | = 15,000 x 2.441 |

| = 46,379 | = 36,615 |

Calculation of Cyclical Maintenance Cost For Flat Roof

| Design A | Design B |

|---|---|

| Future Value = 1$ | Future Value = 1$ |

| Discount Rate = 6% | Discount Rate = 6% |

| Flat Roof – $35,000 (10 Years Period) | Flat Roof – $40,000 (20 Years Period) |

| 10th Year = 0.558 | 20th Year = 0.312 |

| 20th Year = 0.312 | |

| 30th Year = 0.174 | |

| Total DF = 1.044 | Total DF = 1.044 |

| Flat Roof = Cost x DF | Flat Roof = Cost x DF |

| = 35,000 x 1.044 | =40,000 x 0.312 |

| = 36,540 | = 12,480 |

Calculation of Cyclical Maintenance Cost For Replacing Window

| Design A | Design B |

|---|---|

| Future Value = 1$ | Future Value = 1$ |

| Discount Rate = 6% | Discount Rate = 6% |

| Replace Window – $70,000 (15 Years Period) | No any Replacements |

| 15th Year = 0.417 | |

| Total DF = 0.417 | |

| Replace Window = Cost x DF | |

| = 70,000 x 0.417 | |

| = 2,919 |

Calculation of Total Life Cycle Cost

| Design A | Design B |

|---|---|

| Total LCC = 216,550+ 693,157+ 55,895+ 46,379+36,540+ 2,919 | Total LCC = 264,750+ 605,292+ 34,470+ 36,615+ 12,480 |

| 1,051,440 | = 953,607 |

As per the above calculation, the most economical design based on value for money over the project life cycle is Design B.

Conclusion

Life cycle cost (LCC) is a method used to calculate the total cost of a construction project over its operational period in present value. This approach has several objectives, such as predicting cash flow, choosing the most suitable design by looking at economic implications, and ensuring effective management of the building throughout its life cycle.

LCC is especially important when deciding between project proposals with the same facilities and requirements. It helps to identify the most suitable type of requirement which can increase the capital cost (construction cost), but also significantly reduce future costs such as maintenance and operating costs. Additionally, LCC is used to manage the facility throughout its life cycle period.

In order to accurately calculate LCC, it is essential to factor in inflation for future costs. The inflation discount factor is taken into account for this purpose. If there are changes in the inflation of the country, the discount factor will also be different. Sensitivity analysis can be used to help the client choose the best project proposal based on its life cycle cost. Ultimately, LCC helps to achieve sustainable projects.

Read more about Provisional sum and Prime cost sum.

2 thoughts on “Life Cycle Costing in Construction: Benefits, Formula & More”